Mike Robins

COO / Integrator

Dynamic Edge, Inc.

Country: United States

Available to: North America, Europe

Language: English

Volunteer: Yes

Availability

- Webinars

- Conferences

- Workshops

- Moderation

- Schools & Charities

- Meetups

- Panels

Expertise

- IT Consulting & Services

- Technology

- Leadership

- Business

- Employee Retention

- Credit Unions

- Accounting

- Healthcare IT

- Information Technology & Services

Testimonails

“Mike makes complicated Tech Topics seem easy with a clear and organized presentation. He inspires innovation and offers a solution to every problem.”

Ron Smith

CEO, Enbright Credit Union

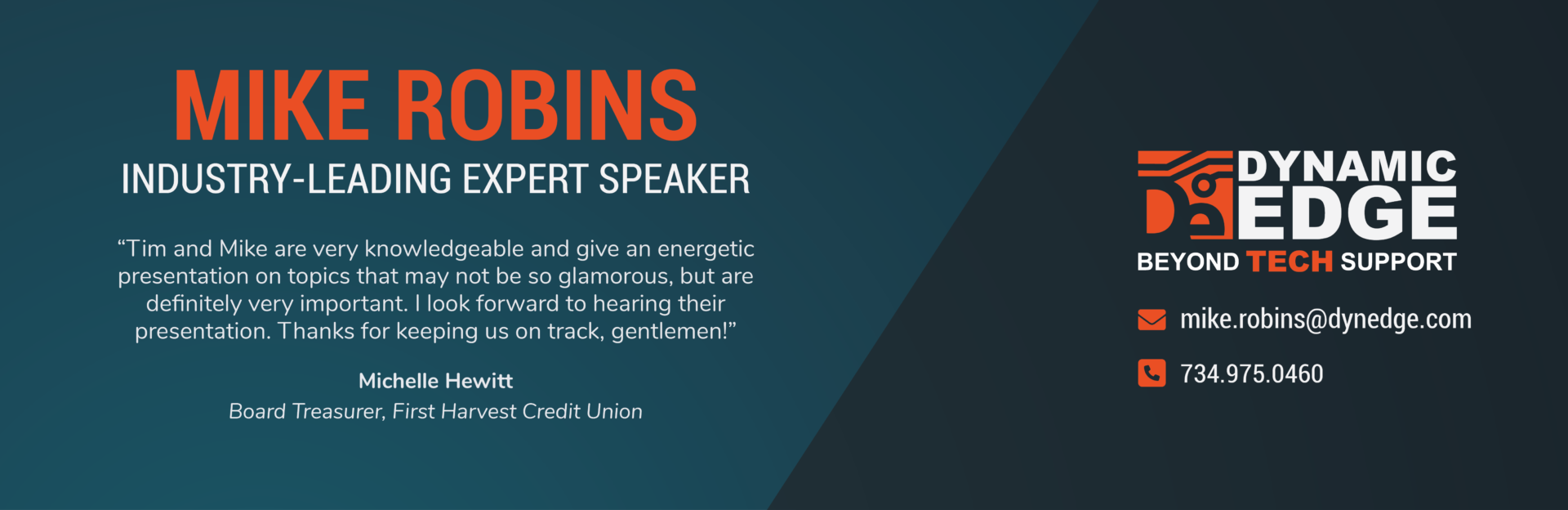

“Tim and Mike are very knowledgeable and give an energetic presentation on topics that may not be so glamourous, but definitely very important. I look forward to hearing their presentation. Thanks for keeping us on track, gentlemen!”

Michelle Hewitt

Board Treasurer, First Harvest Credit Union

Mike Robins is the COO/Integrator of Dynamic Edge, Inc. He offers 25 years’ experience in technology, having served as both an internal Director of Information Technology and external Consultant to small and large financial institutions. Mike earned an MBA from the Keller Graduate School of Management with concentrations in Information Technology and Human Resources. He holds numerous technical certifications, including Project Management Professional (PMP) and Information Technology Infrastructure Library (ITIL) 4 Foundations. He speaks frequently at credit union conferences and board meetings.

Dynamic Edge has offered world-class, flat-rate managed IT and cyber security services for over 20 years. The team eliminates down time through constant maintenance, proactive planning, cloud hosting, cyber security solutions, and unlimited IT support. We help credit unions meet NCUA requirements not simply to pass the exam, but to secure their members. We’re not just computer support, we’re Beyond Tech Support.

Fight Fraud with Zero Trust

According to the Association for Certified Fraud Examiners, internal control weaknesses are responsible for nearly half of fraudulent activity. Aggressive cyber terrorists and stale technology policies put your members’ assets and your organization’s reputation at significant risk. A path to Zero Trust offers hope and opportunity for credit unions. Zero Trust represents the largest technological paradigm shift in at least a decade. It not only recommends new security tools implemented in a new way, but also requires a cultural mindset change from employees and members. This session will explain how a Zero Trust security posture will protect your credit union against the ever-evolving range of cyber threats, prepare your credit union for a successful NCUA audit, and protect your members from increasingly creative attempts at insider and external fraud.

Protect Assets and Reputation through Technology

In 2022, the average ransomware payout was $570,000, up from $312,000 in 2021. Cyber insurance is more important than ever, particularly for financial institutions. However, the insurance application and policy renewal processes become more complicated every day. When executives and board members put insurance matters on “auto pilot,” they place their members’ assets and their credit union’s reputation at significant risk. This session will identify the critical components of an acceptable cyber insurance policy, discuss the challenges of the annual renewal process, and explain how to collaborate with your provider in the event of a cyberattack. Finally, it will explain the “why” behind key conditions and exclusions, so that executives and board members may make informed decisions.

Credit Union Security: Old & Especially New Threats

Is your Credit Union safe and secure? Are you certain? This session will describe the importance of a formal risk assessment, security best practices and how proper IT network administration dramatically reduces both risk and fraud. The session will also highlight the most common internal/external threats for 2023 and how credit unions may detect them before they do damage.

How to Talk to Your IT Team

As a credit union executive or board member, you have a lot on your plate. Ensuring the safety and security of your members and their assets, maintaining your business from an operations standpoint, and taking care of your valuable employees are all keys to the success of your institution. One often-overlooked thing unites all three of these concerns: technology. It’s easy to pass off that responsibility off to your IT director, since they have the expertise to keep things running. However, instituting regular checks and balances is essential to prevent technological time bombs. In order for your business to succeed, YOU – not just your IT team – have to understand the ins and outs of your network environment. This session will identify five major topics related to technology, explain them in comprehensible language, and describe how best to discuss them with your IT team.

How to “Pass” the NCUA Tech Audit (Without Losing Your Mind!)

For many credit unions, preparing for the NCUA audit conjures images of stressful Supervisory Committee meetings, adversarial debates with your technology team, and frustrating conversations regarding a lack of progress on last year’s deficiencies. It doesn’t have to be that way. This session will recommend a practical, proactive approach to your annual audit. It will help you prioritize audit findings, budget proactively based on reasonable project scopes, and demonstrate to auditors that you are making consistent progress with internal controls. Finally, it will empower you not only to “pass” the NCUA test, but more importantly, protect your members’ assets from cyber threats and internal/external fraud.

How to Leverage Tech to Achieve Economic Scale

While credit union consolidation has held steady at 3.5% per year for the past 40 years, the average asset size of credit unions continues to grow, with more organizations over the $1B threshold than ever before. Increasing cyber security threats and NCUA compliance compel credit unions to maximize their technology investment or face extinction. No longer exclusively a cost center, technology actually offers credit unions a massive opportunity to achieve economic scale. This session will identify 2022’s most important strategic investments and describe how to balance internal tech teams versus external service providers. For smaller credit unions, the session will recommend ways to achieve tech scale, while also preparing their environments for merger. For larger credit unions, the session will highlight how to evaluate the right tech elements within an acquisition target.

“Protect Assets and Reputation Through Technology”

National CU Supervisory Committee Conference

San Juan, Puerto Rico – January 2024

“How to Talk to Your IT Team”

National CU Supervisory Committee Conference

San Juan, Puerto Rico – January 2024

“Protect Assets and Reputation Through Technology”

North Jersey Chapter of the CrossState Credit Union Association

Elizabeth, NJ – February 2024

“How to ‘Pass’ the NCUA Tech Audit (Without Losing Your Mind!)”

CU Conferences’ Detecting Fraud & Managing Risk Conference

Hyatt Regency, Savannah, GA – June 2023

“Navigating the NCUA’s New Information Security Examination (ISE) in 2023”

LSCU Council Conference (SCUCE)

Signia by Hilton Orlando Bonnet Creek, Orlando, FL – June 2023

“Navigating the NCUA’s New Information Security Examination (ISE) in 2023”

National Credit Union Management Association (NCUMA) Spring Conference

Ritz-Carlton, Amelia Island, FL – May 2023

“How to Leverage Tech to Achieve Economic Scale”

National Credit Union Management Association (NCUMA) Winter Conference

Grand Hyatt, Kauai, HI – November 2022

“Credit Union Security: Old & Especially New Threats”

League of Southeastern Credit Unions (LSCU) Technology Council

Virtual – September 2022

“How to ‘Pass’ the NCUA Tech Audit (Without Losing Your Mind!)”

National Credit Union Management Association (NCUMA) Fall Conference

Park Hyatt, Beaver Creek, CO – September 2022

“Protect Assets and Reputation through Technology”

National Credit Union Management Association (NCUMA) Summer Conference

Grand Hyatt Baha Mar, Nassau, Bahamas – July 2022

“How to Talk to Your IT Team”

League of Southeastern Credit Unions (LSCU) Council Conference

Hilton Orlando Bonnet Creek, Orlando, FL – June 2022

“Fight Fraud with Zero Trust”

National Credit Union Management Association (NCUMA) Spring Conference

Ritz-Carlton, Amelia Island, FL – May 2022

“HIPAA: In the Home and On the Road”

National Home Infusions Association Conference

Gaylord Opryland Resort and Convention Center, Nashville, TN – March 2022

“Dynamic Edge Shares Importance of Cybersecurity for Credit Unions”

CU Broadcast Episode 2834

https://www.cubroadcast.com – February 2022

“How to Talk to Your IT Team”

National Credit Union Management Association (NCUMA) Winter Conference

Grand Wailea Resort, Maui, HI – November 2021

“Credit Union Security: Old & Especially New Threats”

National Credit Union Management Association (NCUMA) Fall Conference

Snow King Resort, Jackson Hole, WY – September 2021

“Managing the Next Generation to Success”

National Credit Union Management Association (NCUMA) Summer Conference

Sweetgrass Inn, Isle of Palms, SC – July 2021

“Business Continuity in a Post-Pandemic World”

National Credit Union Management Association (NCUMA) Spring Conference

Ritz-Carlton, Amelia Island, FL — May 2021