Most people, including me, think of Section 179 as some mysterious or complicated piece of tax code. The bottom line is that it is important that you understand what this specific code means for your business because you may be missing out on big deductions.

In this post, I’ll walk through Section 179 in plain English and explain how your investment in computer equipment might be the perfect way of you to take advantage of this deduction.

First, what the heck is the Section 179 Deduction?

Section 179 of the IRS tax code lets businesses deduct full purchase price of qualifying equipment—which includes computers and software— purchased during the tax year. What this means is when your business buys qualified equipment or software, they can deduct the FULL PURCHASE PRICE from your gross income. The logic behind why Section 179 exists? To encourage businesses to buy equipment and invest in their businesses.

How Section 179 Works?

Basically, when your business purchases certain equipment and software, you are able to write off purchases little by little over time because it depreciates in value. For instance, if you purchase a server for $100,000, you get to write off (lets say) $25,000 for four years. Note: these numbers are just my dummy example. Your accountant will know the specifics!

But wouldn’t you rather just write off the entire purchase up front? That’s why Section 179 was originally written—to motivate spending in the American economy. For most businesses, the entire cost of equipment and software can be written off for the 2015 tax return.

There are caps to the total permissible amount written off, currently $25,000 for the 2015 tax return. After the first $25,000 complete deduction, additional deductions phase out dollar-for-dollar after $200,000 is spent.

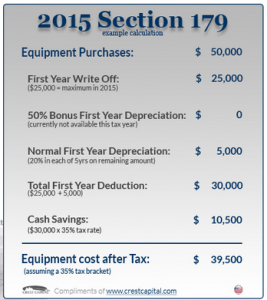

Let me lay it out with a little example. Let’s say you had made equipment purchases totaling $50,000 in 2015, all of which was covered by the Section 179 Deduction. Below is an example calculation to figure out your total deductions for the year and how much you would actually be paying for your purchased equipment in 2015.

Do you qualify?

All businesses that purchase, finance or lease less than $200,000 in new or used business equipment during 2015 should qualify for the deduction. The purchased equipment must be used for business purposes at least 50% of the time to qualify. To understand the amount a specific piece of equipment qualifies for the deduction, you can simply multiply the percentage used for business purposes by the cost of the equipment! You’re your accountant will know the nitty gritty about the specifics to Section 179- I encourage you to reach out to them to see if you are making the most of your deductions!

Computer equipment and software are included in the Section 179 Deduction!

Any computer needs- laptops, desktops, servers, routers, out-of-the box and custom-built software are eligible for the Section 179 deduction! I want to make sure you are taking action and getting your maximum benefit! But to reap the benefits of Section 179 for this fiscal year, you need to act quickly. The deadline for purchases to be claimed for 2015 is quickly approaching! Contact me today to come up with a game plan for any imminent computer spending you had been considering and let’s figure out a strategy for you to get the most out of your deductions!